Flexible Digital Lending Solutions and Credit Cards in India with CredNow

In today's quickly developing financial landscape, the need for personalized, efficient, and tech-driven lending solutions has become more important than ever. Whether it's a salaried employee in need of immediate funds, a freelancer trying to find working capital, or a business attempting to broaden its operations, the shift towards digital loans and {tailored| financial products is undeniable. Amidst this dynamic community, CredNow emerges as a trusted and futuristic digital platform that bridges the gap between loan applicants and available funding, particularly concentrating on instant personal loan offerings and charge card that deal with a wide range of customer profiles.

The traditional banking system, while dependable in many ways, often lags in agility and customization. This is where fintech platforms like CredNow are changing the lending area, offering users a smooth digital interface to use, track, and manage loans and credit products without the inconvenience of physical documents or long waiting periods. The value proposition offered by CredNow is its flexibility and inclusiveness. From personal loan for freelancers to loan for self employed people and even micro loans , the platform acknowledges that financial needs are not one-size-fits-all.

Among the standout offerings of CredNow is the instant personal loan feature, designed for people who require instant access to funds. Emergencies like medical costs, education fees, or urgent travel needs typically need fast financial intervention. With minimal documentation and a simple digital KYC procedure, users can get loans in simply a few clicks and receive approvals nearly immediately. This convenience makes CredNow a vital solution for today's fast-paced lifestyle where time and availability are vital.

For entrepreneurs and startups, CredNow likewise helps with business loans , ensuring that even small business and new endeavors can get the capital they require to grow. These loans are {tailored| based on business needs, creditworthiness, and payment capabilities, offering versatile payment terms that align with business cycles. The platform's ability to support small company owners and startups with simple financing options reflects its commitment to economic inclusion.

Freelancers and gig economy professionals typically deal with challenges when it pertains to borrowing due to irregular income patterns and minimal credit rating. Recognizing this space, CredNow offers personal loan for freelancers -- a unique product that evaluates alternative credit metrics such as digital footprints, {client| agreements, and transaction history instead of relying exclusively on conventional credit scores. This opens borrowing opportunities for a section that is often neglected by conventional lenders.

In India's financial context, the function of micro loans can not be overstated. These small-ticket loans are particularly helpful for self-employed people and micro-entrepreneurs who need fast access to working capital. Whether it's a street vendor wanting to broaden inventory or a home-based artisan needing raw materials, micro loans act as an economic driver. CredNow assists in micro lending with an emphasis on digital onboarding and paperless disbursals, making it an ideal partner for grassroots financial addition.

Another prominent offering on the CredNow platform is a curated selection of charge card suited for diverse consumer needs. In 2025, the variety of best charge card in India includes options that accommodate investing patterns, rewards preferences, and cost structures. From cashback cards to travel rewards and way of life advantages, users can compare and make an application for charge card that suit their personal or business needs. CredNow simplifies the choice and application procedure through an user-friendly interface and fast eligibility checks.

An important element for many credit card users is the annual fee . Frequently, high annual fees hinder people from fully utilizing credit card advantages. CredNow addresses this issue by including the best credit cards with no annual fees , giving users the opportunity to take pleasure in advantages without being burdened by recurring charges. These cards are particularly attracting students, first-time credit users, and those who choose a minimalist credit experience.

Understanding the various kinds of credit cards in India can help users make informed decisions based on their lifestyle. Cards are broadly classified into benefits cards, fuel cards, going shopping cards, travel cards, and premium cards. Each card features its own perks-- be it lounge access, fuel surcharge waivers, or loyalty points-- and CredNow plays an educational role by helping users determine which card category aligns with their financial objectives and costs habits.

For self-employed people, conventional financial institutions typically enforce stiff eligibility requirements that leave out many possible borrowers. With CredNow, getting a loan for self employed professionals is a lot more simple. By leveraging alternative data sources such as business billings, online deal history, Personal loan for freelancers and GST filings, the platform ensures that even those without a salaried earnings can access funds. This democratization of credit access is important in a nation like India where self-employment is a substantial part of the labor force.

The digital transformation of the lending sector has actually made digital loans a preferred option for tech-savvy consumers. Unlike conventional loans that involve physical visits to banks and lengthy processing times, digital loans through CredNow fast, secure, and transparent. Everything from loan application to disbursal and repayment tracking can be managed through a mobile device or desktop, bringing convenience to the forefront of the borrowing experience.

The key to CredNow's success lies in its smart integration of technology, data analytics, and user-centric design. Advanced algorithms evaluate applications in real time, reducing human bias and ensuring faster decision-making. The platform likewise maintains strict data privacy protocols, making sure that users' financial and personal details is kept secure at all times. This trust aspect is particularly important in financial services where consumer confidence is paramount.

With rising financial literacy, people are more happy to explore non-traditional lending platforms that offer speed, customization, and better value. CredNow capitalizes on this shift by offering a robust mix of products like business loans , micro loans , credit cards , and instant personal loans , all under one digital roofing. This consolidated approach saves users the time and effort of shopping throughout multiple platforms and provides a consistent, top quality experience.

Another noteworthy advantage of using CredNow is its educational content and customer support, which guide users through their credit journeys. Many first-time borrowers or young professionals may not fully understand loan terms, credit report, or interest calculations. CredNow addresses this space by offering insights, calculators, and real-time assistance that empower users to make smarter borrowing decisions.

As India continues to embrace digital banking and fintech innovations, platforms like CredNow are well-positioned to lead the charge. The convergence of AI-driven danger assessment, personalized financial solutions, and a mobile-first user experience places CredNow at the forefront of modern lending. Its emphasis on inclusion-- whether through loan for self employed , personal loan for freelancers , or charge card with no annual fees -- demonstrates a commitment to serving diverse customer segments with integrity and efficiency.

In 2025, the landscape of personal finance in India is expected to be a lot more digital, dynamic, and demand-driven. Customers will look for not just financial products but value-added experiences that combine convenience, education, and transparency. CredNow is currently pioneering this shift by making financial tools accessible, understandable, and relevant for every single Indian.

Conclusion.

In a world where financial needs are increasingly diverse and time-sensitive, CredNow is redefining the method people access credit and manage their financial lives. Through its suite of offerings-- from instant personal loans to best credit cards in India 2025 , micro loans , business loans , and digital loans -- the platform sticks out as a comprehensive, inclusive, and tech-savvy solution. Whether you are a salaried employee, a freelancer, a self-employed professional, or an entrepreneur, CredNow provides the tools and flexibility to meet your unique financial needs. As digital finance continues to evolve, platforms like CredNow will not just keep up with the rate but shape the future of loaning in India.

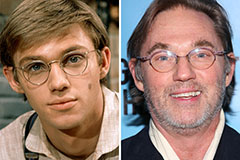

Rick Moranis Then & Now!

Rick Moranis Then & Now! Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now!